MileageCount

Accurate recording of your employees’ business mileage

Save time & money across your business with our smart, automated mileage capture system

Already a MileageCount user? Click Here to Log In

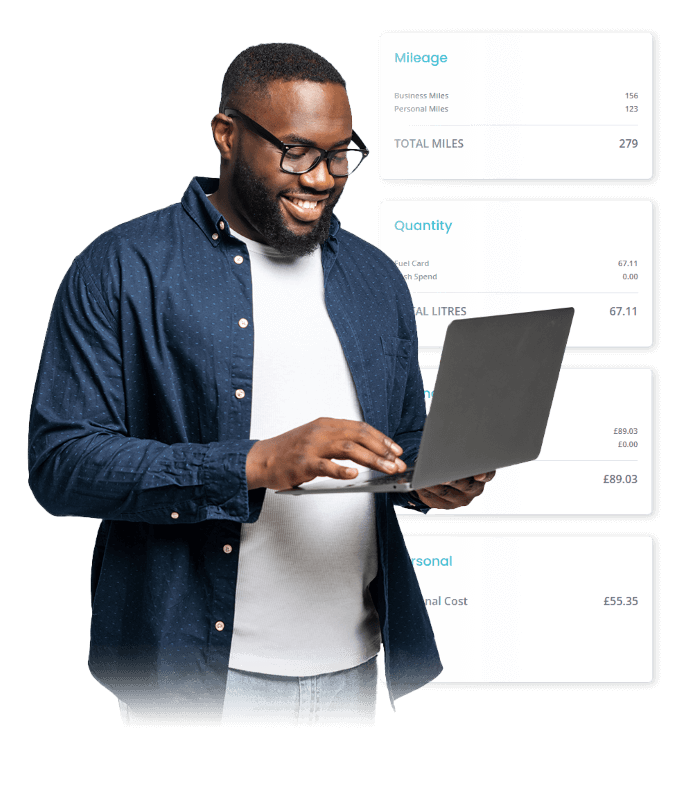

Automatically track your business miles with MileageCount

Save Time Across Your Business

It’s easy for your drivers to log and submit their business miles with MileageCount, but the time savings don’t end there!

Mileage claims can be approved on the easy-to-use portal, and reports can be generated and sent to your payroll or accounting departments.

Reduce the Cost of Mileage Claims

Accurate reporting avoids costly overestimations – no more rounding up to the nearest mile! You’ll also be able to easily spot discrepancies in your mileage reports.

Avoid Fines – Comply with HMRC

Not already recording your mileage properly? You risk a fine of up to £3,000 per failure from HMRC! MileageCount helps you avoid fines related to mileage records.

How Does MileageCount Work?

1. Choose your mileage capture solution

MileageCount lets you track your mileage with a variety of devices. Find the best one for you and start recording your miles!

2. Drivers upload mileage and submit claims

Simply upload your recorded data, check you’re happy with how business and personal mileage is separated, then submit!

3. Managers review the mileage claim

Review mileage claims and approve them – it’s as quick and simple as that.

4. Submit your reports

Create quick and simple reports and easily send them to payroll, your manager or your accountant.

MileageCount lets you track your mileage with a variety of devices. Find the best one for you and start recording your miles!

Simply upload your recorded data, check you’re happy with how business and personal mileage is separated, then submit!

Review mileage claims and approve them – it’s as quick and simple as that.

Create quick and simple reports and easily send them to payroll, your manager or your accountant.

Comply With HMRC Mileage Regulations

HMRC requires accurate mileage reporting. Every journey not correctly reported is not only a business expense but a HMRC risk.

If HMRC find your records are inaccurate, your business could face fines of up to £3,000 per failure!

MileageCount is the easiest way to ensure compliance through accuracy.

There’s no way for drivers to round up or over-estimate. This not only aids compliance, but also saves your business money.

Smart Mileage Counting That Saves You Time

MileageCount makes it easy for managers to view and approve their drivers’ mileage, and your Payroll department will save hours with the helpful reporting features.

How will MileageCount save you time?

No more spreadsheets – drivers can save multiple hours per month by using MileageCount to record their miles.

MileageCount calculates driver’s deductions or reimbursements seamlessly into an automated payroll file.

You can rely on MileageCount with its simple multi-step process to report mileage expenses accurately.

By saving administration time, you regain valuable, wasted hours over the year. The risk of error is also greatly reduced and data capture is all automatic, culminating in stress-free mileage submission.

See What Our MileageCount Customers are Saying

“MileageCount drives innovation and supports our customers with the pressures and complexities of managing a fleet of vehicles.”

Andy Allen, UK Cards Manager, BP Fuel

“Implementing the MileageCount solution has made collating mileage easier for the drivers and allowed Saville to produce accurate management reporting.”

Saville Audio Visual

“Recording accuracy has brought a reduction in business mileage of around 10% to 15%. We have the certainty that no journey is ever missed and each trip is measured with absolute precision.”

Mears Group

No Overclaiming – No Discrepancies

Small inaccuracies and rounding up to the nearest mile can add up to huge financial losses over time.

With MileageCount, drivers no longer have to guess unrecorded mileage or add up multiple long journeys.

With a helpful payroll report, your business can easily spot any discrepancies in your mileage claims. With all business journeys clear, fuel spend easily monitored, and a multi-step approval system, you have peace of mind that all claims are correct.

How to Count Your Mileage

MileageCount supports three non-invasive solutions for recording mileage. Find a solution that fits the needs of your fleet.

Manual with App

No device required. Manual start and stop functions. Journeys automatically recorded & easily uploaded from app to online portal.

USB iBeacon with app

Journeys automatically recorded and easily uploaded from either the Android or iOS app into the driver’s online portal.

Tele-Gence Mileage Counter

Already a Tele-Gence customer? Your journeys are automatically uploaded into driver portal from your tracking device.

Wave Goodbye to Unreliable Spreadsheets

Are you still recording your business mileage expenses in a spreadsheet? You may think this is working for you, but it could be costing your business money.

Recording your mileage expenses in a spreadsheet is time consuming for both drivers and managers. Spreadsheets are also subject to human error – and even fraudulent information.

With MileageCount, all mileage recordings are accurate and automated, and can be easily uploaded to the portal without spending time inputting numbers. Plus, if there are any anomalies, MileageCount makes it easy to detect them.

Frequently asked questions

You have a company to grow, not a fleet to babysit. MileageCount gives your company fast, quantifiable and assured return on investment for any size or type of fleet. It reduces business mileage claims by up to 21% for just a few pounds a month per driver. It gives you fleet management control effortlessly.

MileageCount helps reduce company spend on fuel, shrink expense claims and manage both internal and HMRC reporting. Furthermore, it proves your company’s sustainability from ESOS energy reporting to comprehensive emissions monitoring – accurately and easily.

MileageCount offers a range of driver recording options, all with latest technology benefits.

Drivers can use an Android or iOS app for easy SmartPhone recording and download of journeys. Our iOS platform includes unique fully automated mileage recording, using revolutionary iBeacon technology. We also offer a USB iBeacon, running directly off the power of the vehicle, giving greater capture capabilities.

With every mile accurately record, fleet managers can create reports from the online portal, and rest easy knowing they are being HMRC compliant.

Easily!

Using our unique software solution, the system recognises regular journeys, weekend trips and even journeys done outside of your usual work hours meaning there is less for you to check and edit when it comes to submission. With the effective filter and sort function, the data can be simplified even further for you.

MileageCount can help your fleet reduce business mileage claims, reduce company fuel spend, and manage reporting for HMRC and internally. At a rate of only a few pounds per driver per month, the return on investment comes around quickly and is fully quantifiable.

Google Maps doesn’t have a built-in mileage tracker, so whilst it might be useful for personal mileage tracking it isn’t suitable for fleets with multiple vehicles. Fleet managers can benefit from the integration of MileageCount for mileage tracking. MileageCount automatically tracks and stores data on your fleet’s mileage making it easier for drivers to make mileage claims, and easier for managers to collate data and report to HMRC.

Since 1990, our mission has been to connect businesses with the fuel cards and fleet services that suits their needs.

We’ve partnered with over eight of the leading fuel providers to help your UK business make smart and practical decisions around how you pay for fuel.

Over 50,000 businesses have trusted us to help them manage their fuel costs, and we are even rated ‘Excellent’ on Trustpilot.

Click here to find out more!